Pagantis

Buy Now, Pay Later!

The following pages contain a small sample of my previous experience as a UX Designer in Pagantis.

While at Pagantis, I worked along with other UX designers in the maintenance and development of Paga+Tarde Consumer Finance. As a team, we worked in a wide range of tasks: from improving the copywriting and the overall experience of the online forms, as well as researching our customers' overall experience in search of new insights for improvement or the development of new features.

The works you are about to see were done between 2019 and the first months of 2020.

UX/UI · UX research

UI Improvements

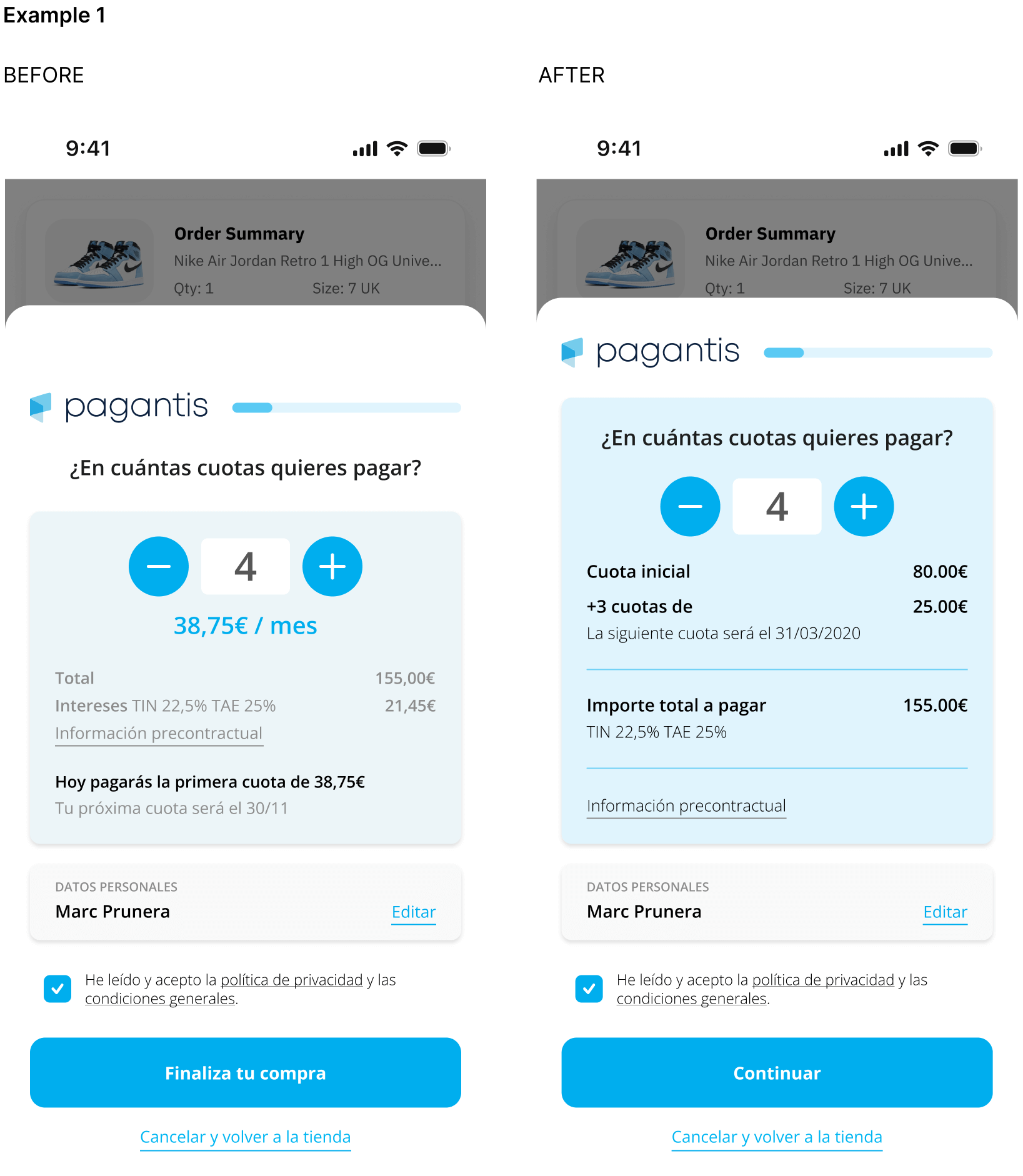

The Instalment's "Calculator" (example 1)

What

Create a new layout for the installments selector.

Why

- Allow the n of flexible installments

- Create a new layout for the installments selector.

How

Grouping the financing details in a table-like structure grouping related information (texts on one side numbers in another one) reducing the user's cognitive load. Allow the n of flexible installments (Pay half today and the other half in 3 months) Create a new layout for the installments selector.

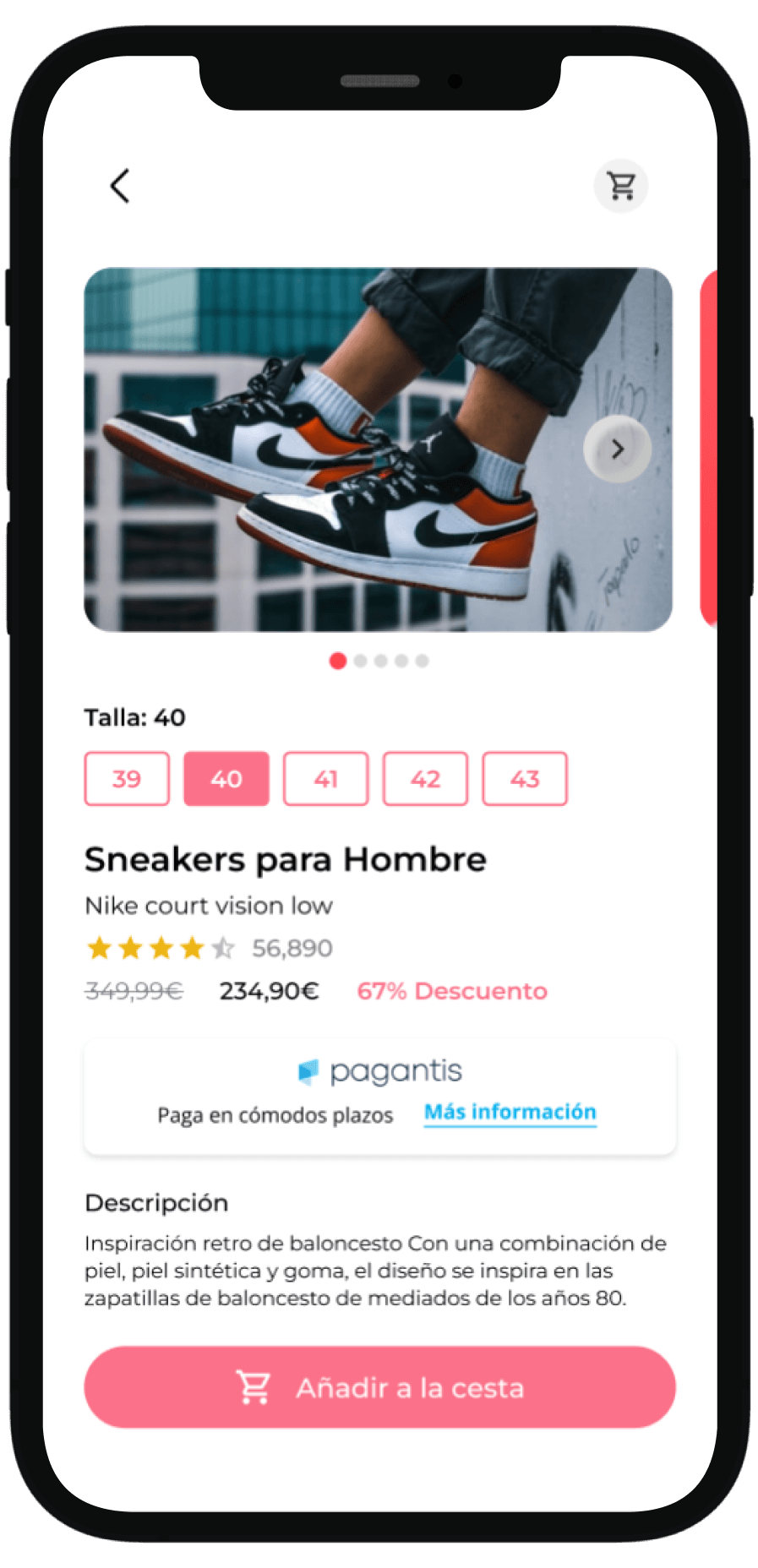

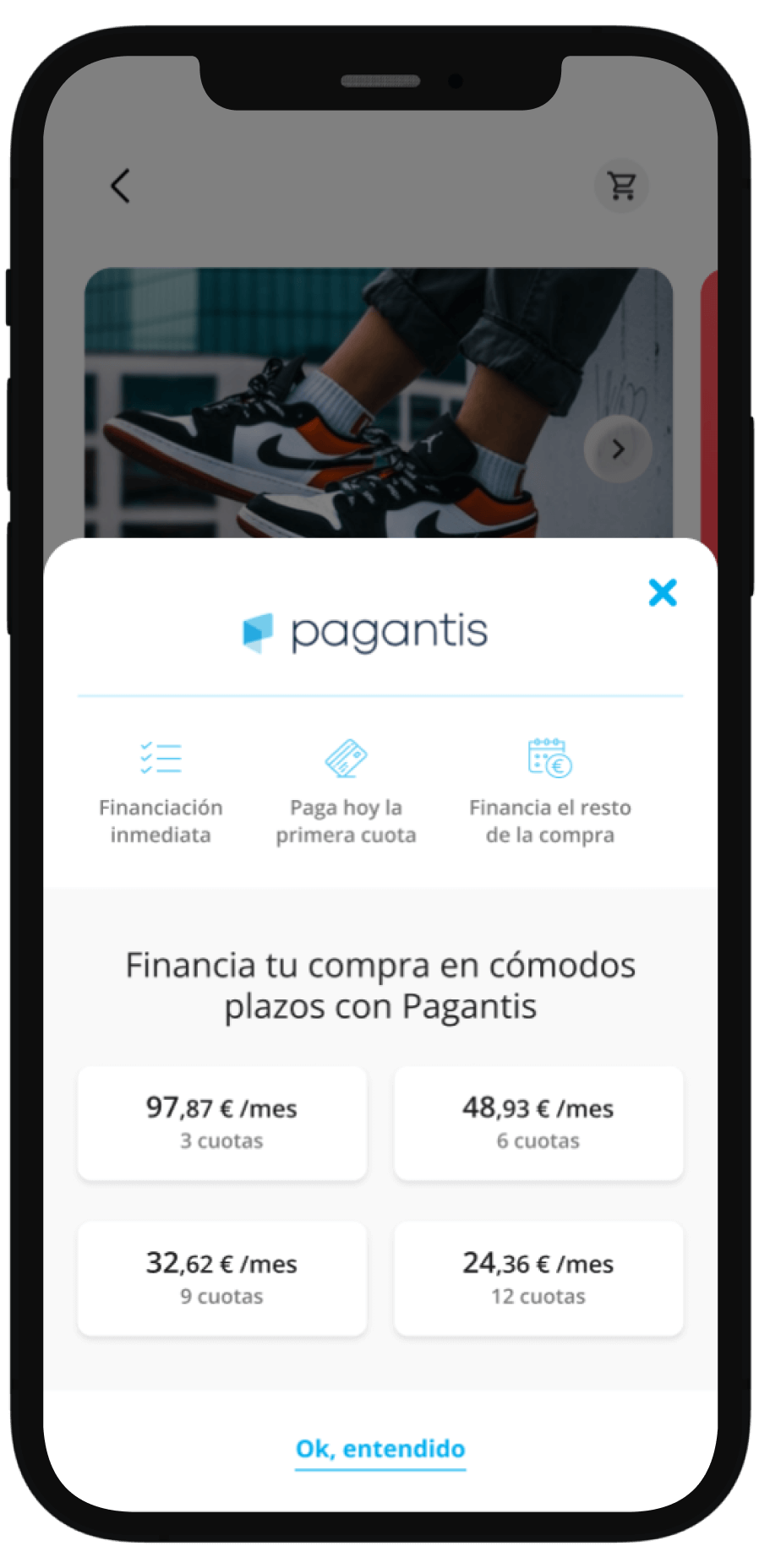

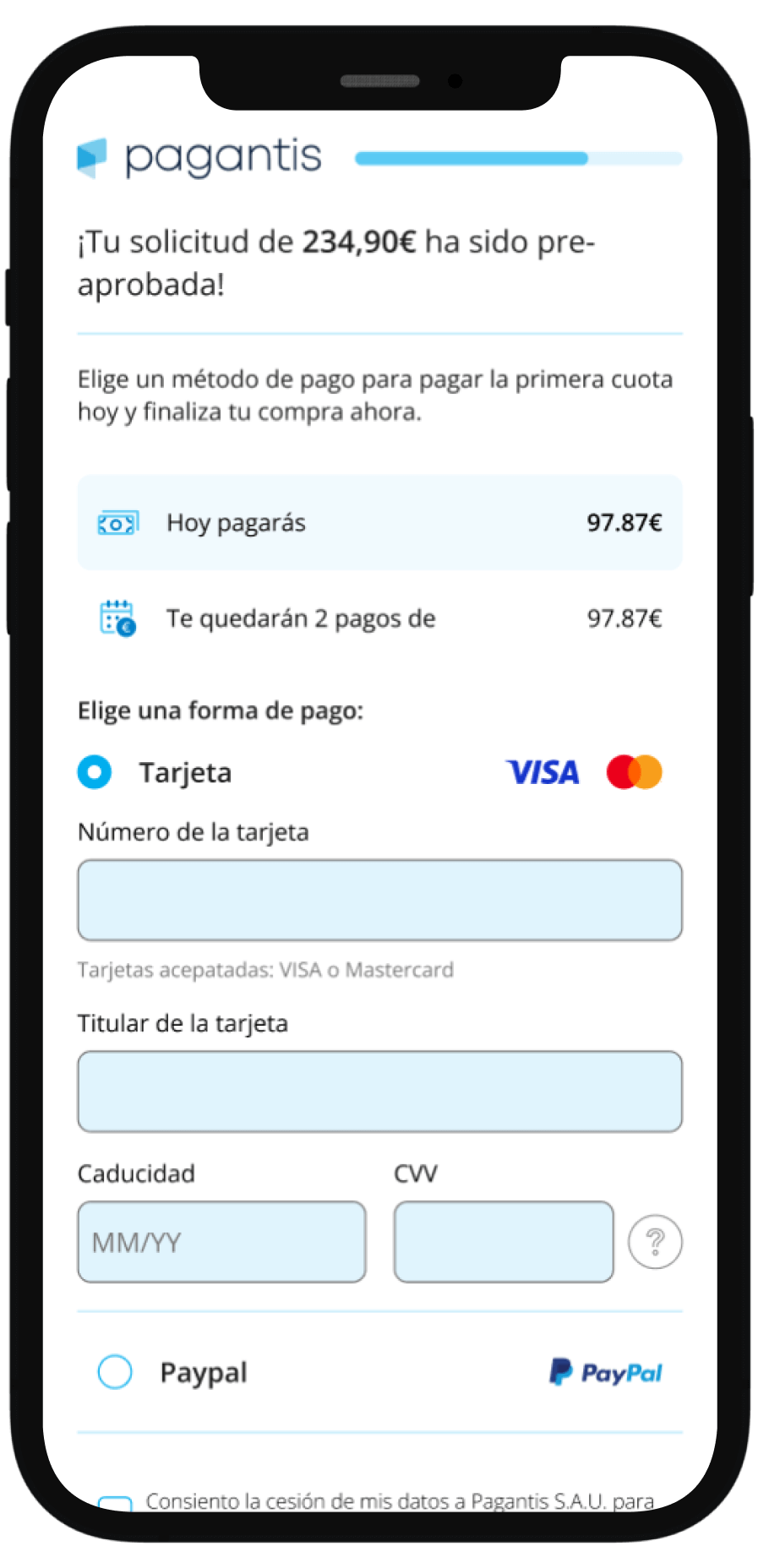

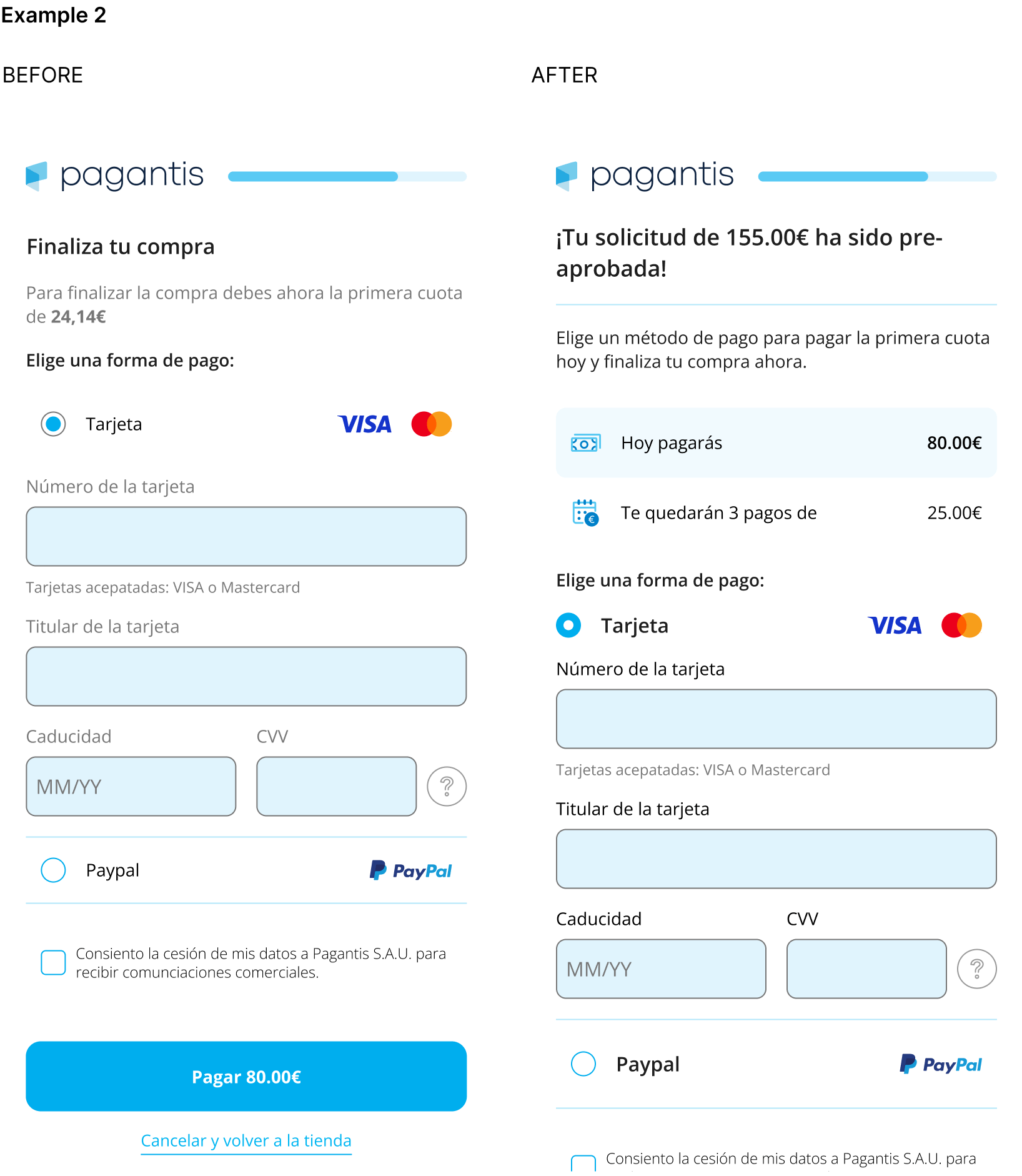

Payment form (example 2)

What

To reduce the user's drop-off at this step.

Why

Applicants were arriving at this screen after a long-form

(KYC steps) and after being pre-approved by the Credit Risk

Engine.

At this point, they were supposed to pay the

first installment to finish the purchase.

How

I wanted to reduce the user's “working memory” and explain what are they paying and why now.

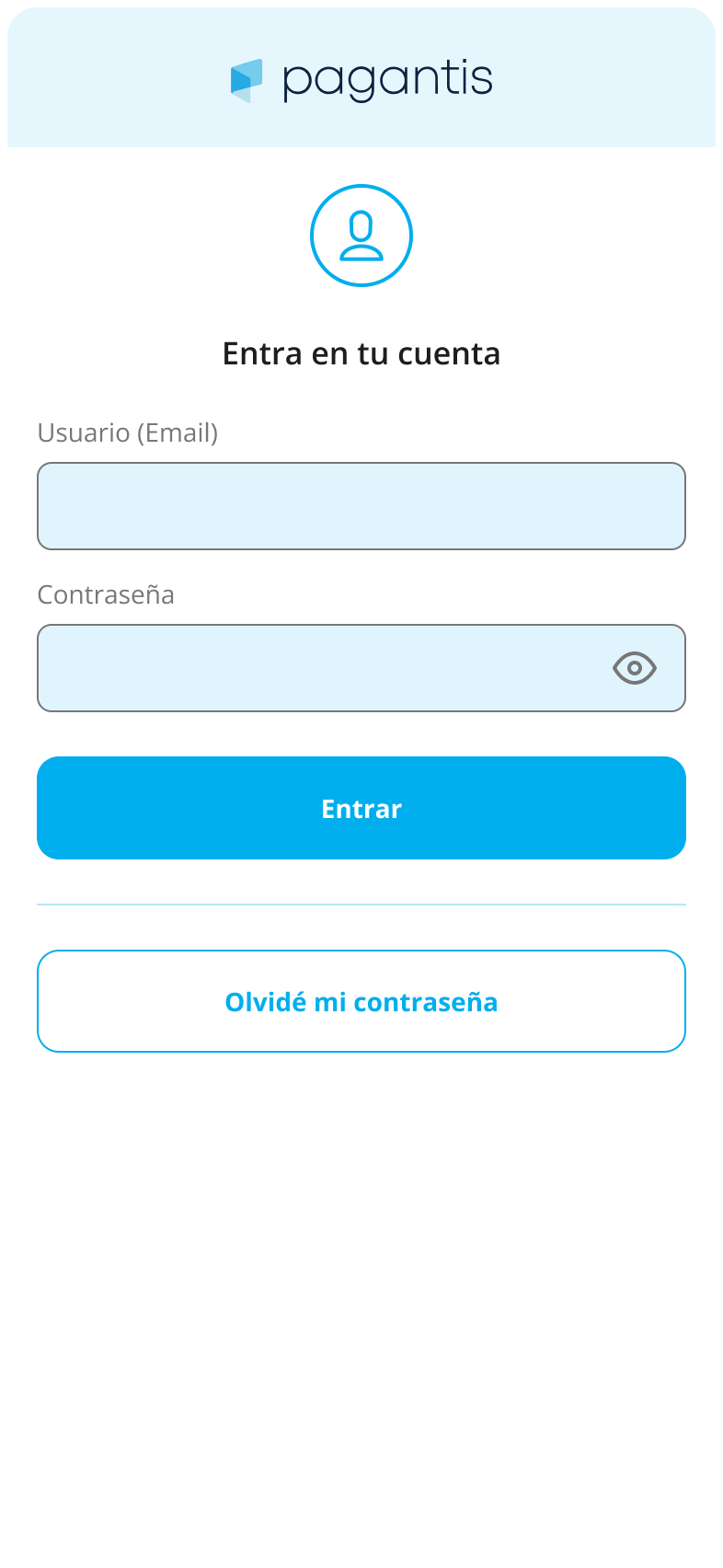

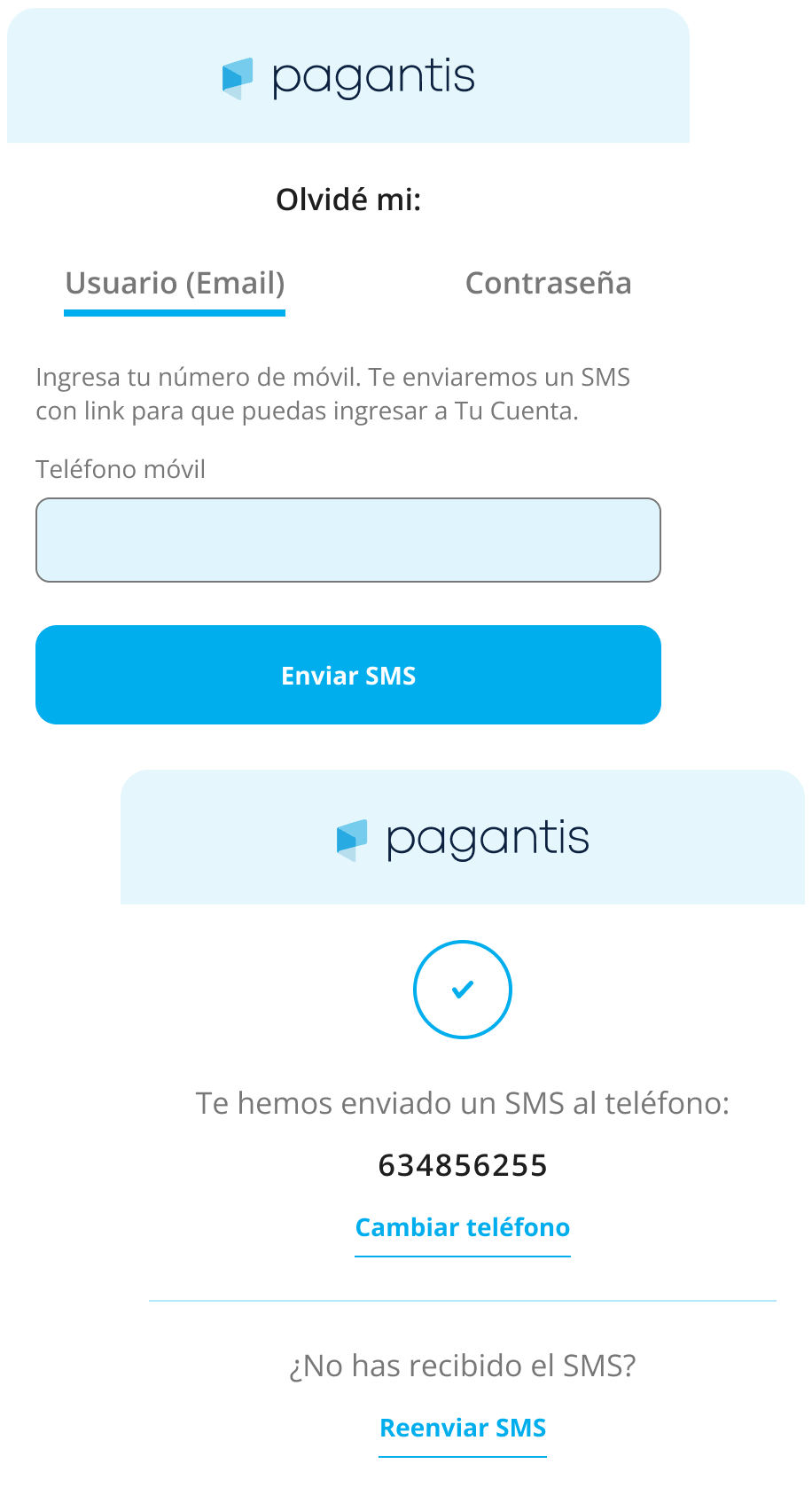

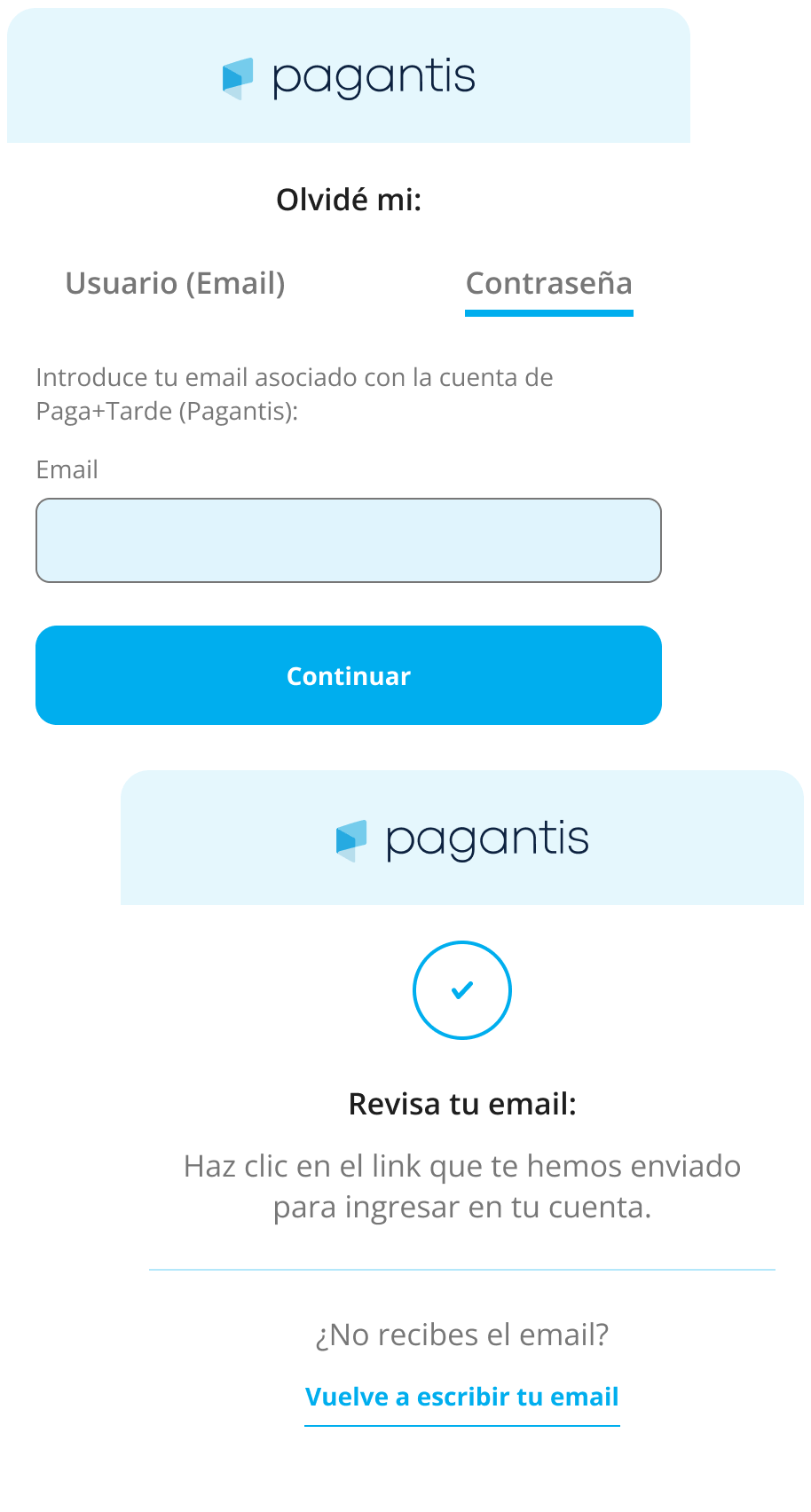

Improving Customer's Login

In August 2019, a new login interface was implemented for Paga+Tarde customers, requiring both new and existing users to create a password associated with their email account to log in.

The Challenge

After three months of implemented, the new login presented the follwoing challenges:

- According to Datadog, almost 200 non-existing accounts.

- A survey was implemented* to gather feedback about the new login. It gather 789 complaints (*Through Hotjar)

- 12% Existing users didn't create a password.

- In average 30 telephone requests every month asking to change the email. But, due to legal requirements, only the Legal Department has the authority to change a user's email address (This process was made manually in the database)

- Users, primarily seniors, don't remember the e-mail account they used when applying for the loan.

- There is a large number of emails with misspelled domains saved in the database. For example: “gamil” or “gnail“ instead of gmail and “holmail” instead of hotmail, etc.

Outcomes

- If users forget their emial we try to identify them with their mobile cellphone.

- When forgeting the password we offer the possibility of login with a “magic link”.

- The development team fixed all misspelled domains saved in the database.

- Suggest to the company to build a tool for the Legal Department allowing them to change user's email.

New Feature

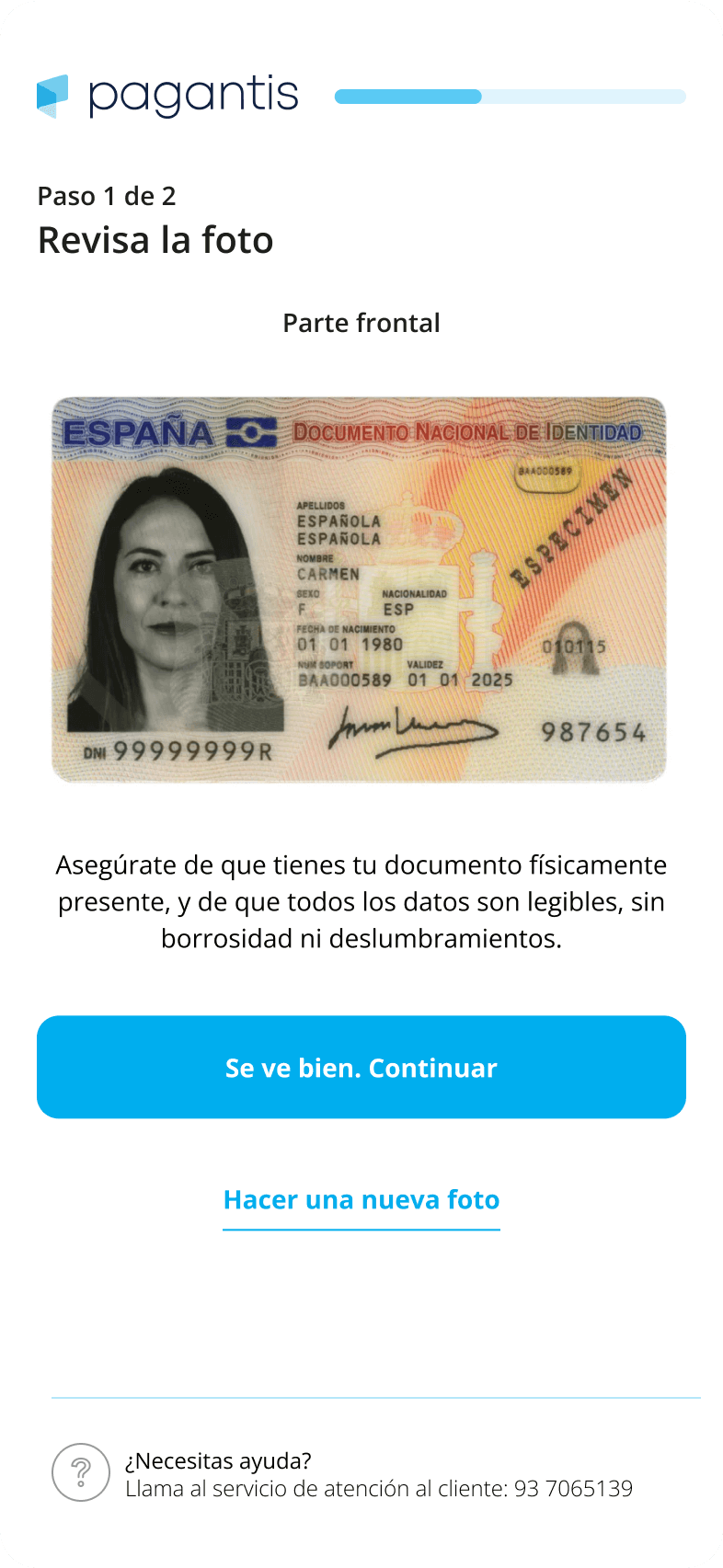

Upload ID in the Application Form

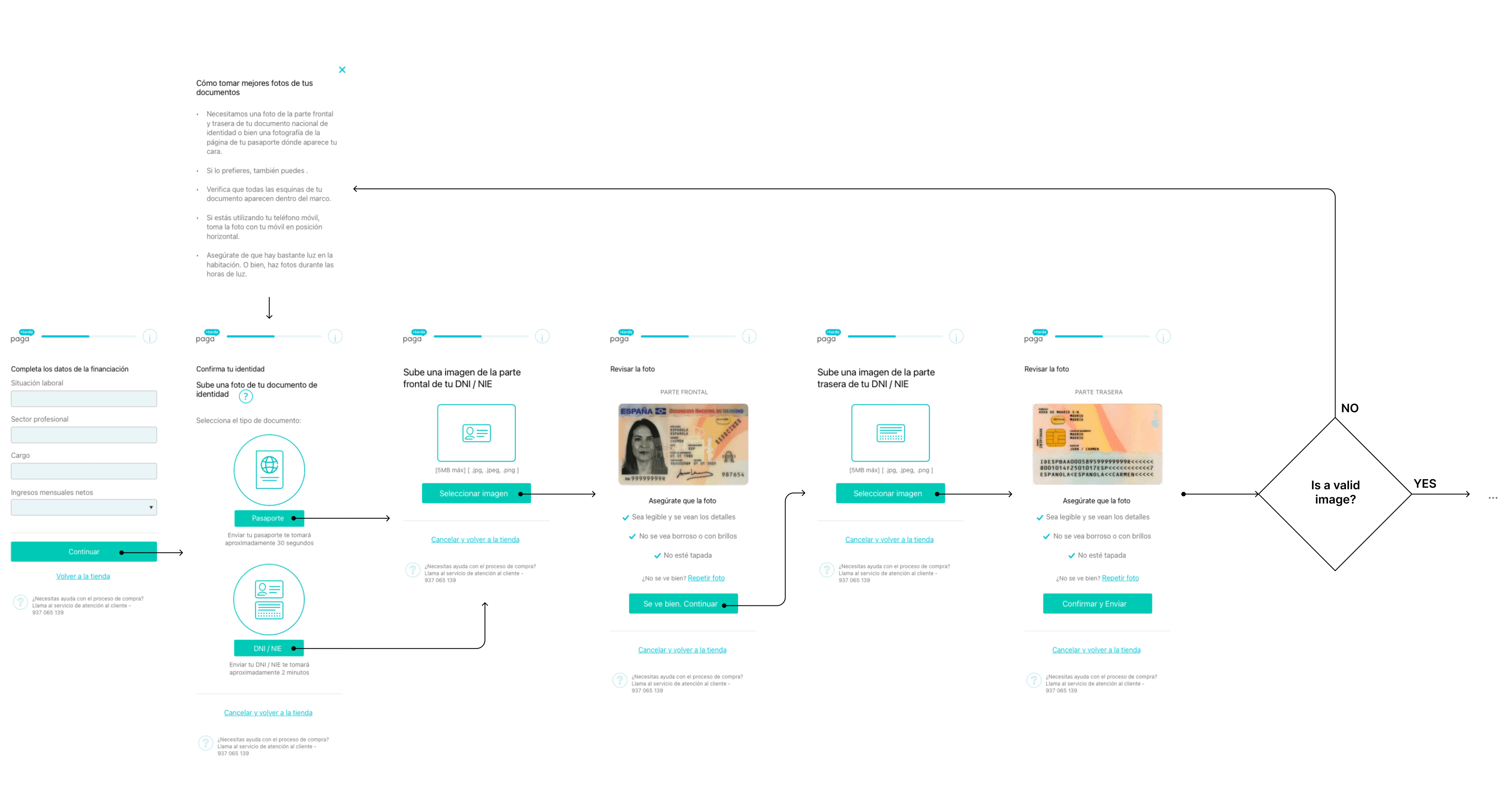

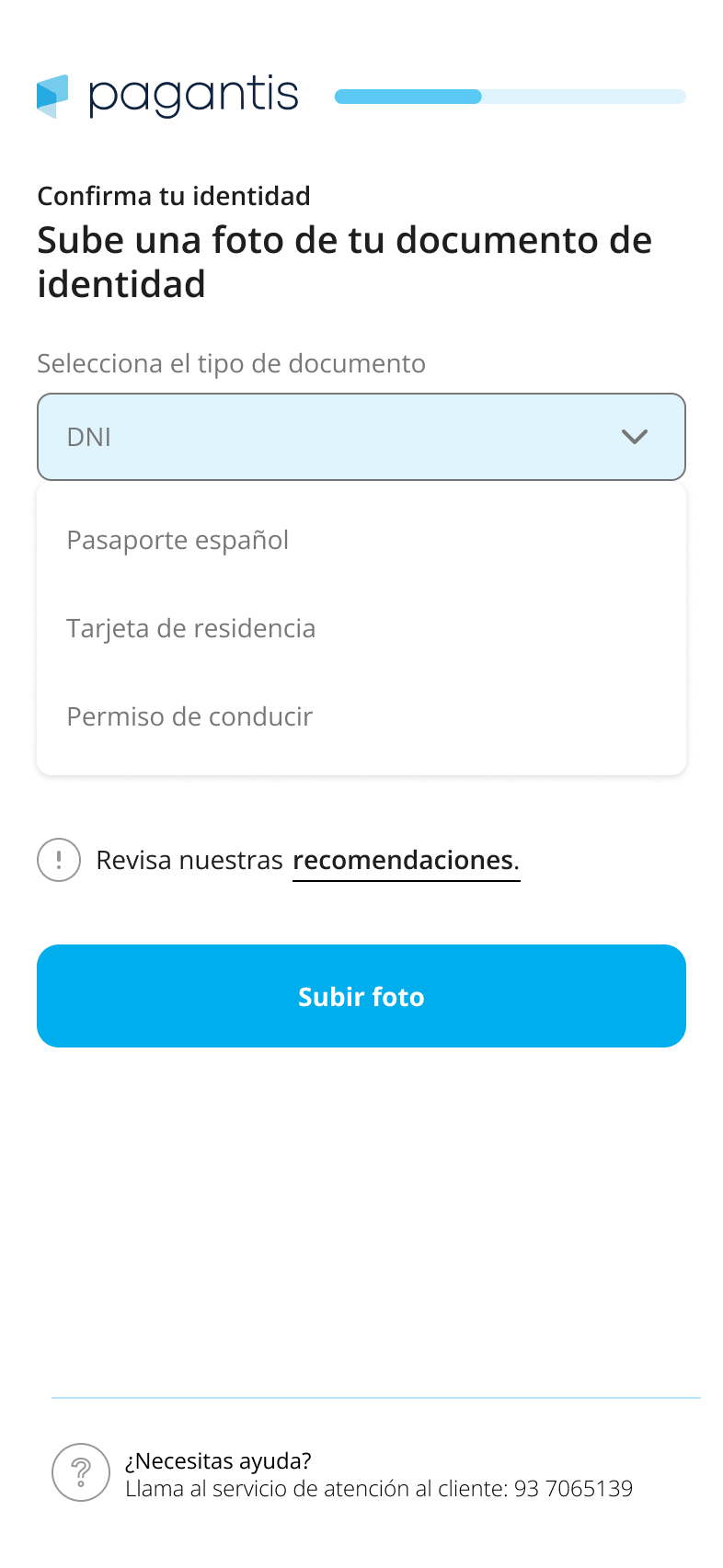

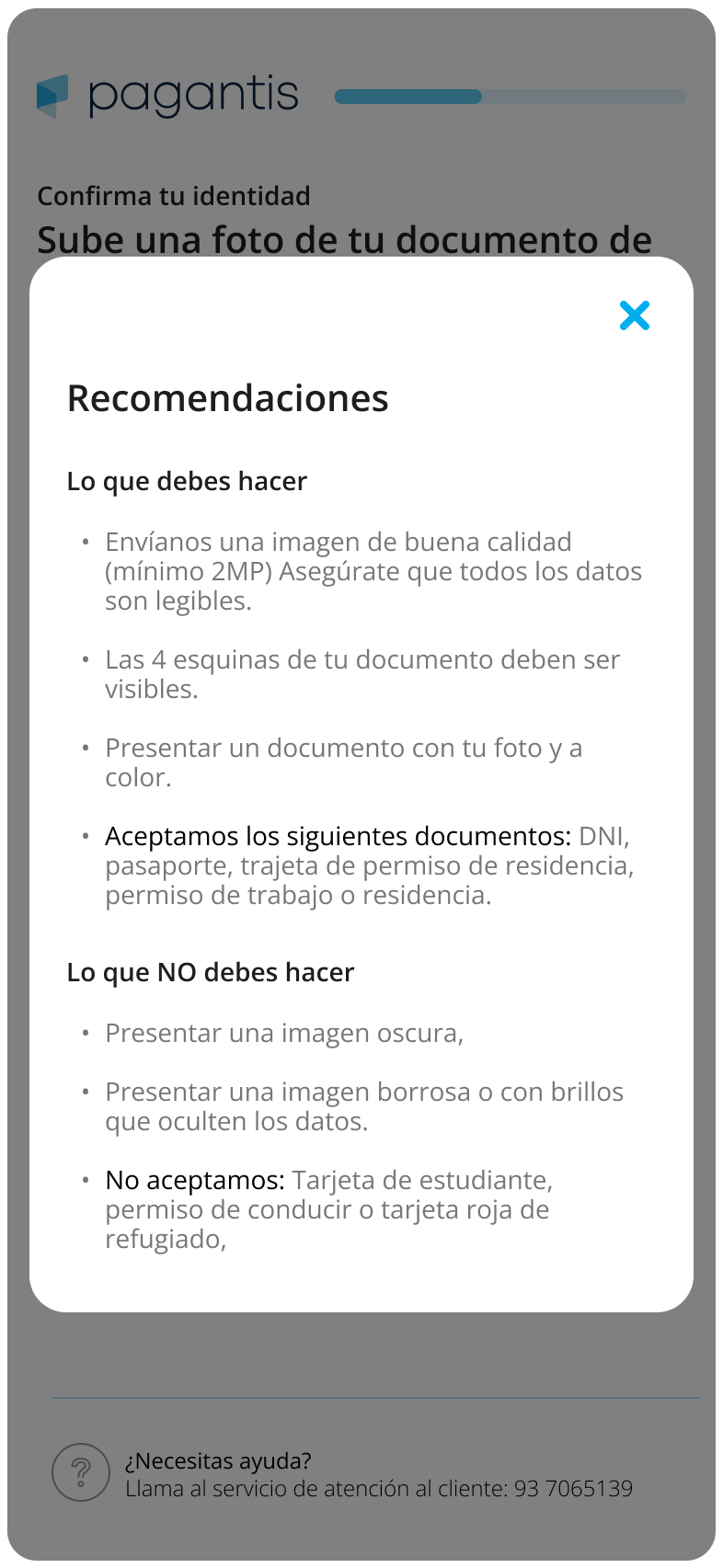

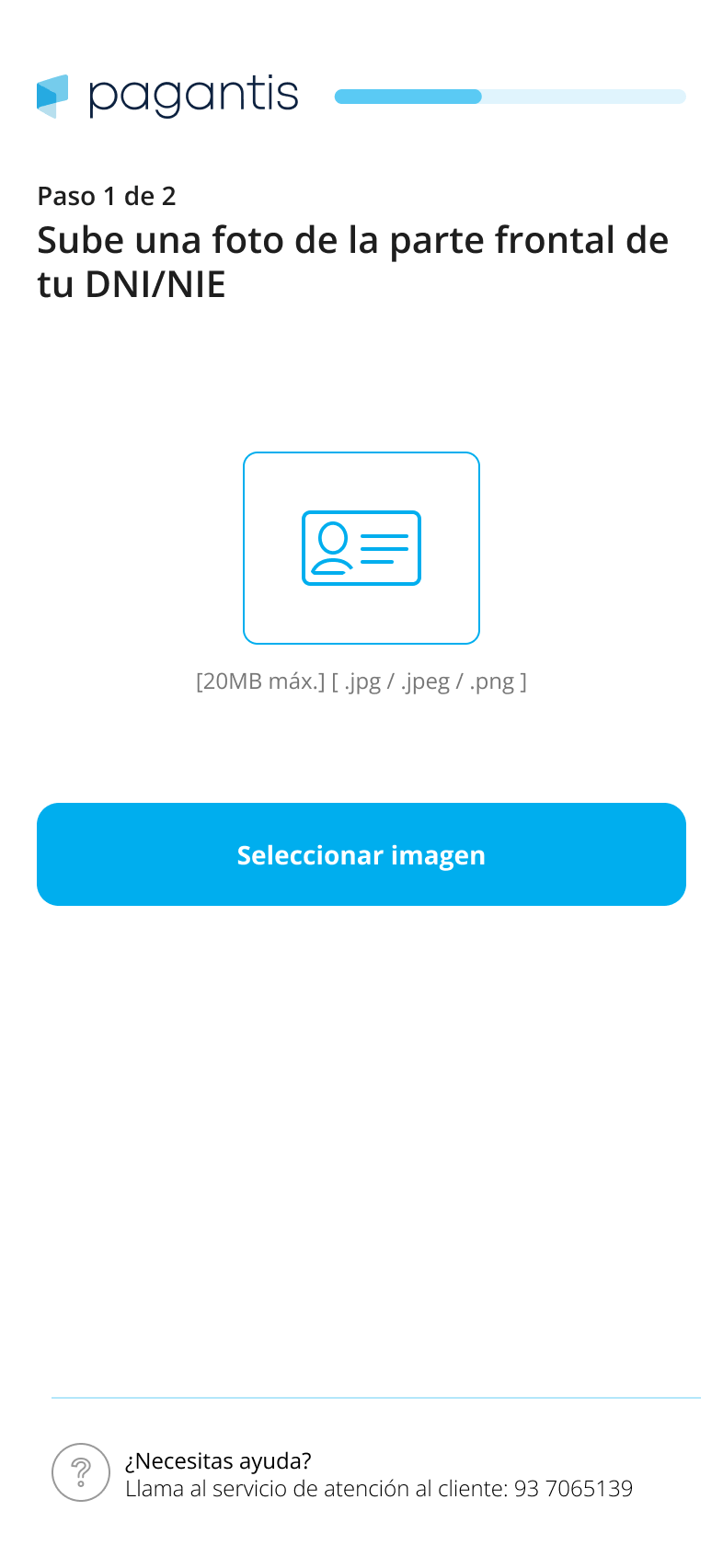

As part of the new AML (Anti-money Laundering) Laws we were forced to start asking our customers to provide an ID Card picture as part of the application form. Together, with developers and the Product Owner we ran a co-creation session in order to implement an MVP for the new feature.

The MVP

After implementing the MVP we started to monitor our users' behavior and found an increment in the number of rejected users because our system was unable to validate their ID's image as a valid or authentic document.

Issue #1: We found out some pictures were upside down.

Along with the Data Team we ran a hackathon and build a custom automation service for rotating the images before validation.

Issue #2: Opening markets in Italy, France and Portugal.

Make it easier to choose different document types according to each country's regulation. For example, in Spain, a valid identity document can be national ID, Passport, and Residence Card. In Italy, there are two different national IDs, one a paper version and the other a plastic card; and the Passport.

Issue #3: Non Spanish citizens living in Spain

In Spain, many European citizens live as permanent residents. However, due to European law, they are not required to have a Spanish identification document and can use their own. Unfortunately, internal anti-money laundering and money recovery processes prohibit giving loans to non-Spanish citizens. However, this was not communicated to Paga+Tarde's customers.

- Users were sending non Spanish documents.

- Some images could not be recognize after several attempts.

- We had many refugees sending their Refugees' ID Card (also known as the "red card")

I consider my years at Pagantis the start of my career as a Product Designer. I was fortunate to work at a startup with 30 employees that quickly grew to over 100. I had my first opportunity to work alongside back-end and front-end developers, bridging the gap between design and development. Also, I built strong friendships across several departments like Customer Support, Legal, Data, Engineering, and Product. This gave me a 360-degree view of both the product and the fintech industry and laid the foundation for my career as a Product Designer. I would like to thank the people I met and worked along side at Pagantis, such as: Laura Arnedo, Edu Aquino, Marta Solís, Albert Viñas, Victoria Arias, Javi Jiménez, Sergi Ortega, Pablo Valdesorio, Jordi Montoya, Iosu Bueno, Clara Abelló, Alberto Martins, Marian López, Jordi Gil, Aroa Cuenca, Jorge Payà, Lluís Ramon, Jordi Puigdellivol, Matías Castañón, Rolf Cederström and Mar Bezanilla, among others.